Before we get into the strategic ways of how to increase customer lifetime value (CLV), let us begin by addressing the age-old battle of customer acquisition vs customer retention.

Did you know that U.S. companies lose $136.8 billion per year due to avoidable consumer switching? And yet, studies show that 44% of companies spend more resources on customer acquisition than retention.

Entrepreneurs become too obsessed with gaining new customers that they forget how important customer retention is! But did you know that a mere 5% boost in customer retention increases business profits by whopping 25% to 95%?

Gaining more and more customers each day won’t make a great impact on your revenue if you keep losing customers along the way. Thus, your focus should be to maximize lifetime value of your existing customers rather than keep on onboarding new ones.

But, how to calculate customer lifetime value (CLV)? The formula to calculate customer lifetime value (CLV) is:

CLV = Average Order Value * Purchase Frequency * Gross Margin * (1/Churn Rate)

where,

Average Order Value = Total Sales Revenue / Total Number of Orders

Purchase Frequency = Number of Orders / Number of Unique Customers

Gross Margin = [Sales Revenue – Cost of Goods Sold (COGS)] / Sales Revenue

Churn Rate = (Number of Customers at End of Time Period – Number of Customers at Beginning of Time Period) / Number of Customers at Beginning of Time Period

You are now ready with the CLV of your business. In this article, I am going to talk about 5 strategic ways of how to increase Customer Lifetime Value (CLV). So, let’s begin!

Customer Tier Segmentation

Every customer has different needs. You cannot treat a one-time customer and a recurring customer in the same way.

Segmenting your customers into different tiers, such as one-time customers and VIP customers, becomes crucial. It allows you to separate high spending customers with low spending customers.

You can further use these different buying personas of your customers to market and improve customer lifetime value (LTV) in your business.

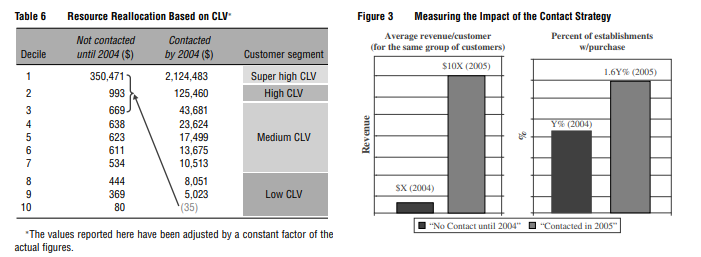

Here’s how IBM increased its revenue by 10x just by segmenting their high spending customers from the low-spending one and marketing to them.

Customer tier segmentation will also help you in the targeted personalization of your products and services. A little personalization goes a long way and here it can serve two purpose – reduce marketing costs and increase customer lifetime value (CLV).

Did you know that 77% of consumers choose, recommend, and even spend more for a business that offers a personalized service or experience?

For instance, Zillow – a real estate company used customer segmentation to send the right marketing messages to its different customer segments, depending on their life cycle stage. They witnessed a whopping 161% increase in their open rates!

Besides this, if you are calculating customer lifetime value without tier segmentation, you are doing it wrong! Here’s why.

Let’s say that you acquire 2 customers – one with a retention rate of 100% and another one with a retention rate of 0%. So, in reality, the first customer keeps on paying forever while the other one leaves after their first purchase.

But, if you consider both of these customers in the same group, you have 2 consumers with an average retention rate of 50% which is not true!

Takeaway: Divide your consumers into different tiers – high-spending and low-spending. Market your services to high spending customers to maximize customer lifetime value (CLV) in your business.

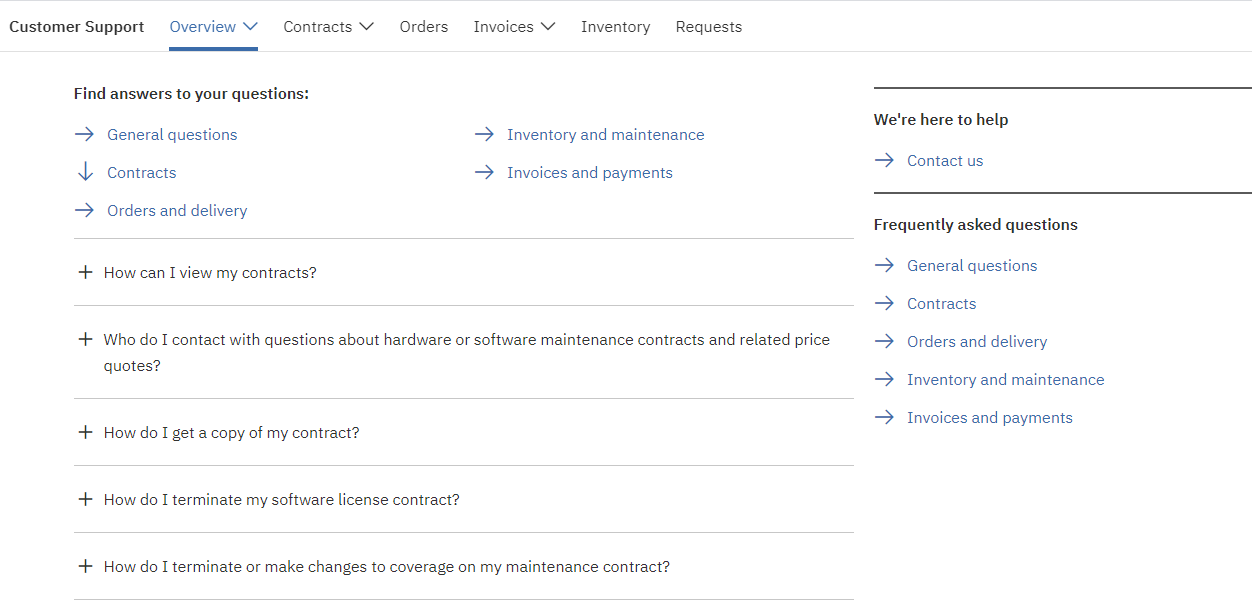

Maintain a Knowledge Base

Have you noticed that lately almost every company, SaaS or otherwise, has an FAQ section, video tutorials, or set of blogs explaining their products or services?

Well, it’s not a mere coincidence.

FAQs, video guides, and other supporting documentation are part of Knowledge Base. A company’s Knowledge Base is basically a self-serve library of information about a company’s product, service, department, or a particular topic!

- As per Social Media Today, 91% of consumers would rather use a Knowledge Base to address a concern about a company’s product or service.

- According to Hubspot, by the end of 2020, no human interactions will be needed in the company-client relationship.

- A survey by Salesforce says that 84% of millennials have used a self-service portal to find an answer to their customer service question.

Knowledge Base will help your users understand your services and use your products in a better way. It will also set up exceptional customer service in your business for CLV boost in your company.

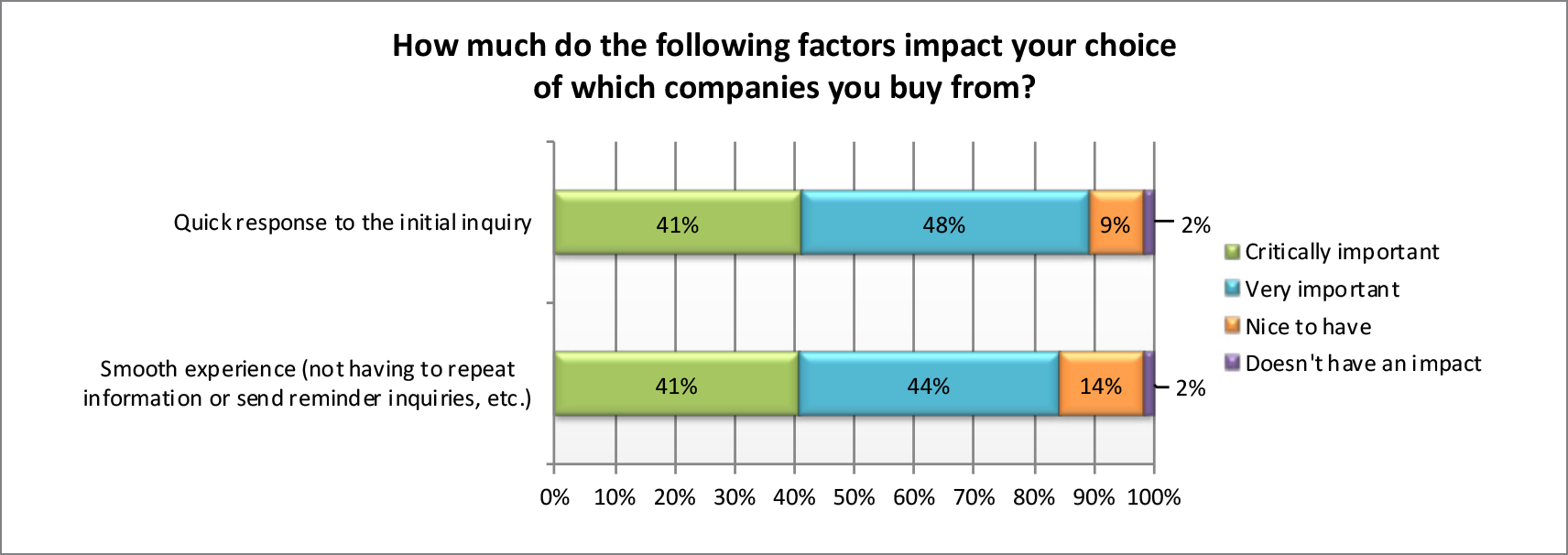

Invest in creating a truly resourceful Knowledge Base. As you can see, 41% of your customers look for a quick response to their inquiry when making a buying decision. It could be for their first-time interactions or even subsequent interactions.

Takeaway: Using a knowledge base will help you increase lifetime value (LTV) by improving the customer experience of your business.

Collect Actionable Feedback

“Your customers can tell you the things that are broken and how they want to be made happy. Listen to them.” – Mark Cuban

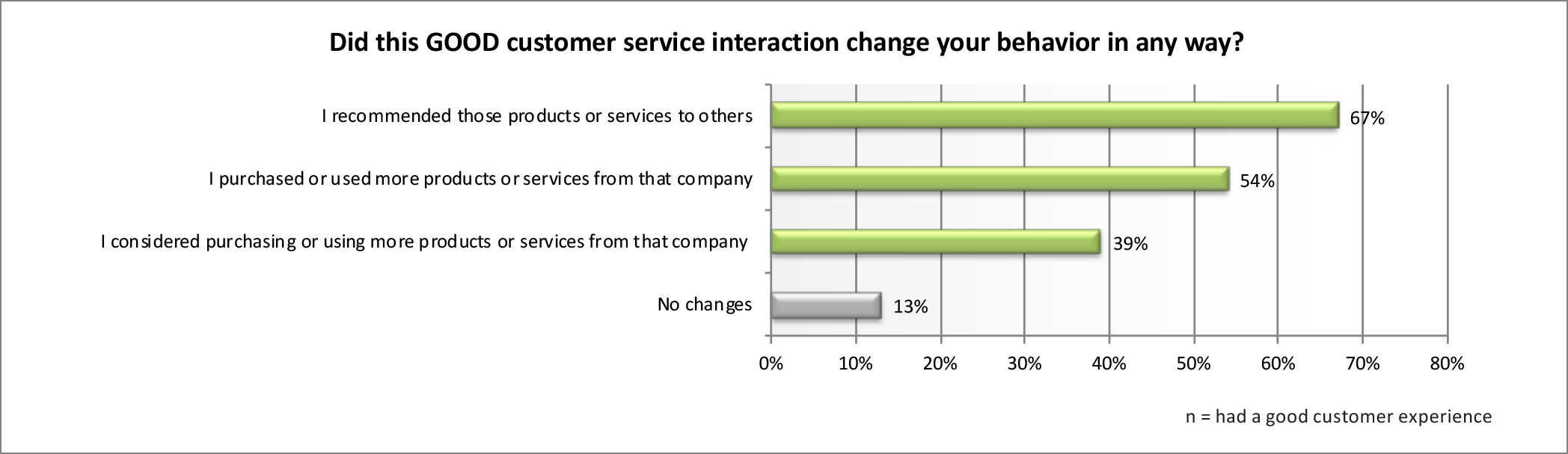

Everyone loves giving opinions and when collecting feedback, it plays in your favor. Your customers feel valued when you ask about their experience or their feedback. A simple rule of thumb says happy customers are more likely to stay with a business than the unhappy ones which will improve customer lifetime value (CLV).

Did you know that 86% of people were likely to repurchase from the same company, thus providing CLV boost, after a great consumer experience?

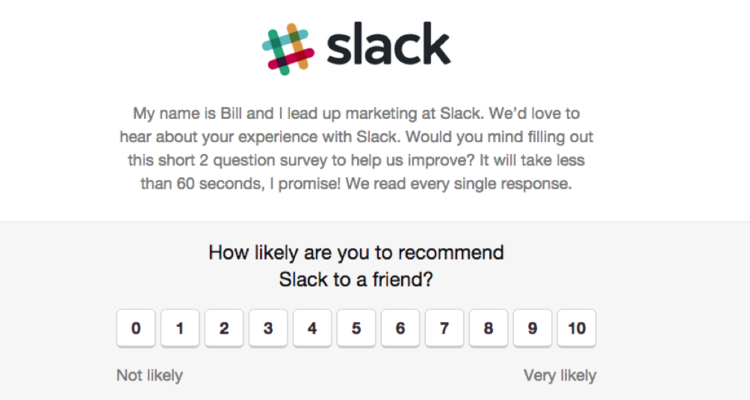

Slack crossed $1 billion evaluation within just 1 year of its launch. Bill Macaitis, then CMO of Slack, emphasized the importance of customer feedback by saying – “Every CEO should be able to answer this question: What are the top 3 reasons why people recommend and do not recommend your brand?”

So, how can you collect actionable feedback to increase lifetime value of your customer?

- Set up a team to address customer concerns and generate feedback on social media.

- Send out a detailed & personalized CSAT or NPR survey to a customer after every interaction. Motivate him/her to fill out this survey.

- Collect all the obtained data to identify areas that fuel customer satisfaction in your company and address them.

Collecting actionable feedback from your customers and analyzing it will allow you to maximize customer lifetime value (CLV).

Takeaway: Collecting actionable feedback using NPR and CSAT surveys for LTV boost of your business!

Increase Average Contract Value

One of the most effective ways to maximize customer lifetime value (CLV) in your business is to increase the average contract value. Here’s why.

Remember the formula to calculate customer lifetime value I mentioned in the beginning. Well, that formula says that the more your average order value or average contract value is, the higher will be its LTV!

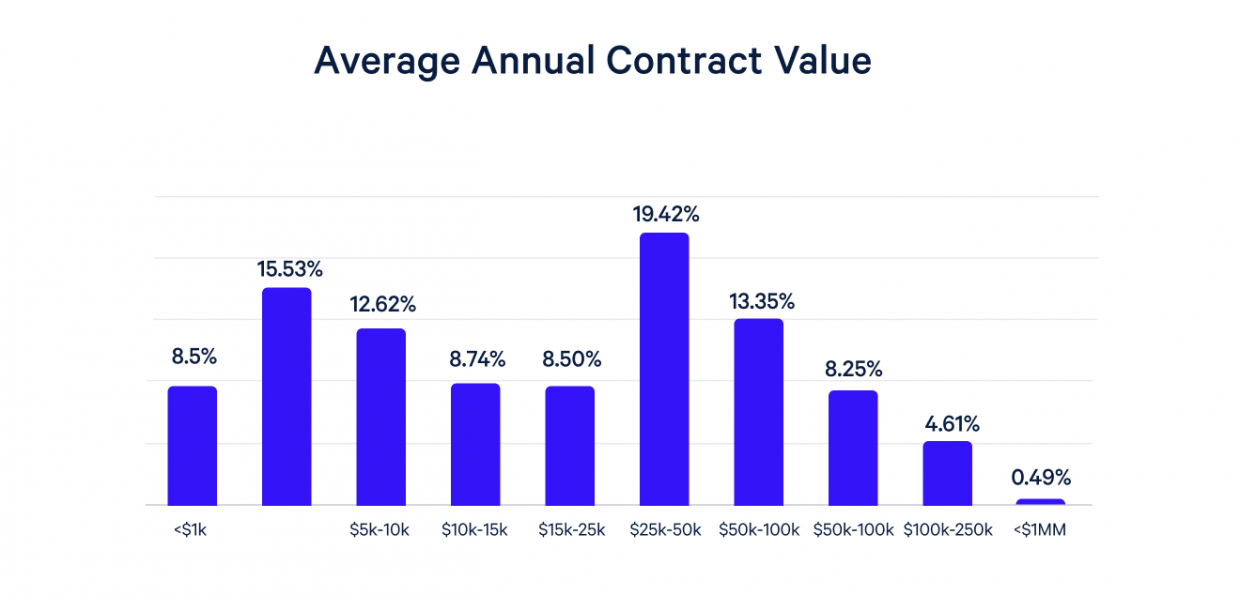

The Average Contract Value (ACV) is basically how much your business makes per contract. Studies show that the most common annual average order value is between $25k-50k.

So, how can you improve Customer Lifetime Value (CLV) by working on increasing your average contract value?

- Encourage your clients to switch to a longer-term billing, say annual billing, to increase customer lifetime value (LTV). You can do so by swapping discounts for value-added extra subscriptions.

- You can consider shifting to a subscription-based revenue model to improve customer lifetime value (CLV) of your company.

- Create obvious upsell opportunities for your clients. Some examples of this are – end-to-end service solutions, added coaching/consultation, offering exclusive content, etc.

These strategies can provide impact results when you are looking at how to increase Customer Lifetime Value (LTV) in your business.

Having said that, the output of this strategy can differ for B2B as well as B2C companies.

For instance, companies like Spotify or Dropbox, have low AOV or ACV but have a higher number of consumers. It’s working for them because their Customer Acquisition Cost is comparatively lower than companies like Salesforce and Citrix.

On the other hand, companies like Salesforce who have higher Customer Acquisition Cost have to have higher Average Contract Value to achieve their revenue goals.

The point is you can have lower Average Contract Value if you can bring in more customers at lower costs. But, if your customer acquisition cost is higher, you must boost customer lifetime value (LTV) to stay functional!

Takeaway: Increasing the average contract value will keep your clients engaged with your business in the long run!

Reduce Churn Rate

Did you know that a healthy yearly churn rate is just 5-7%?

Working on reducing churn rate can help you to increase customer lifetime value (CLV) of your business. A study shows that reducing customer churn by 5% can boost your business profits 25-125%.

Here’s how popular companies work on reducing their churn rate to improve customer lifetime value.

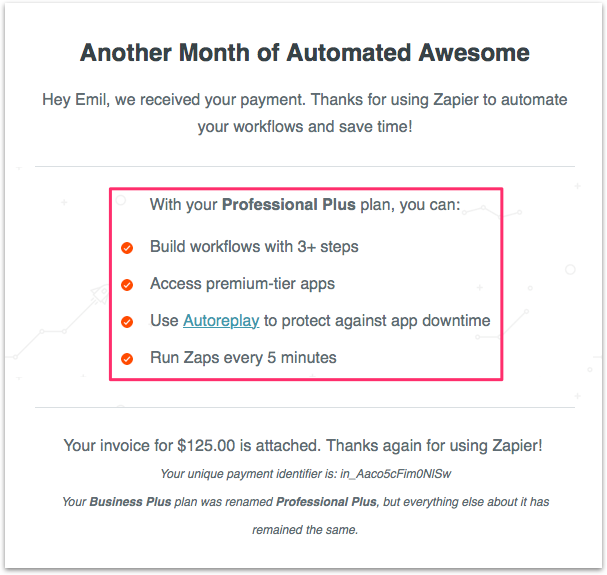

- Zapier sends a list of benefits of using its software along with its monthly invoice.

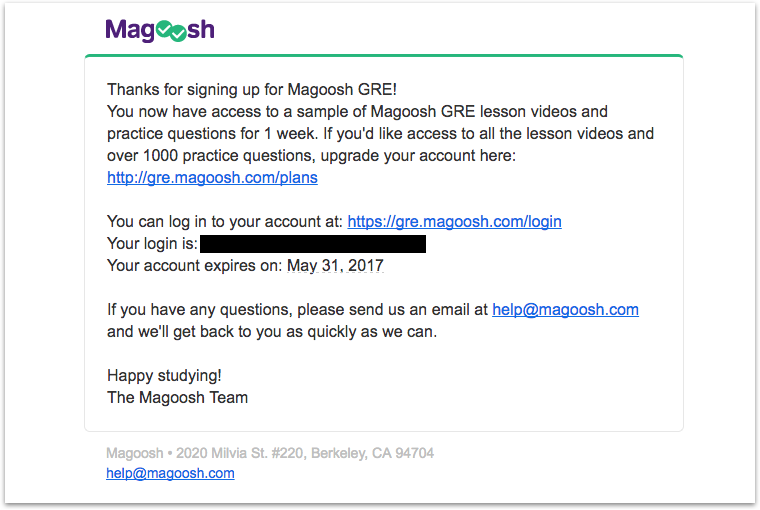

- A poor onboarding experience can cause a significant rise in the churn rate of your company. Magoosh increased its signups by up to 17% by simply sending out this welcome email & improving its consumer onboarding flow.

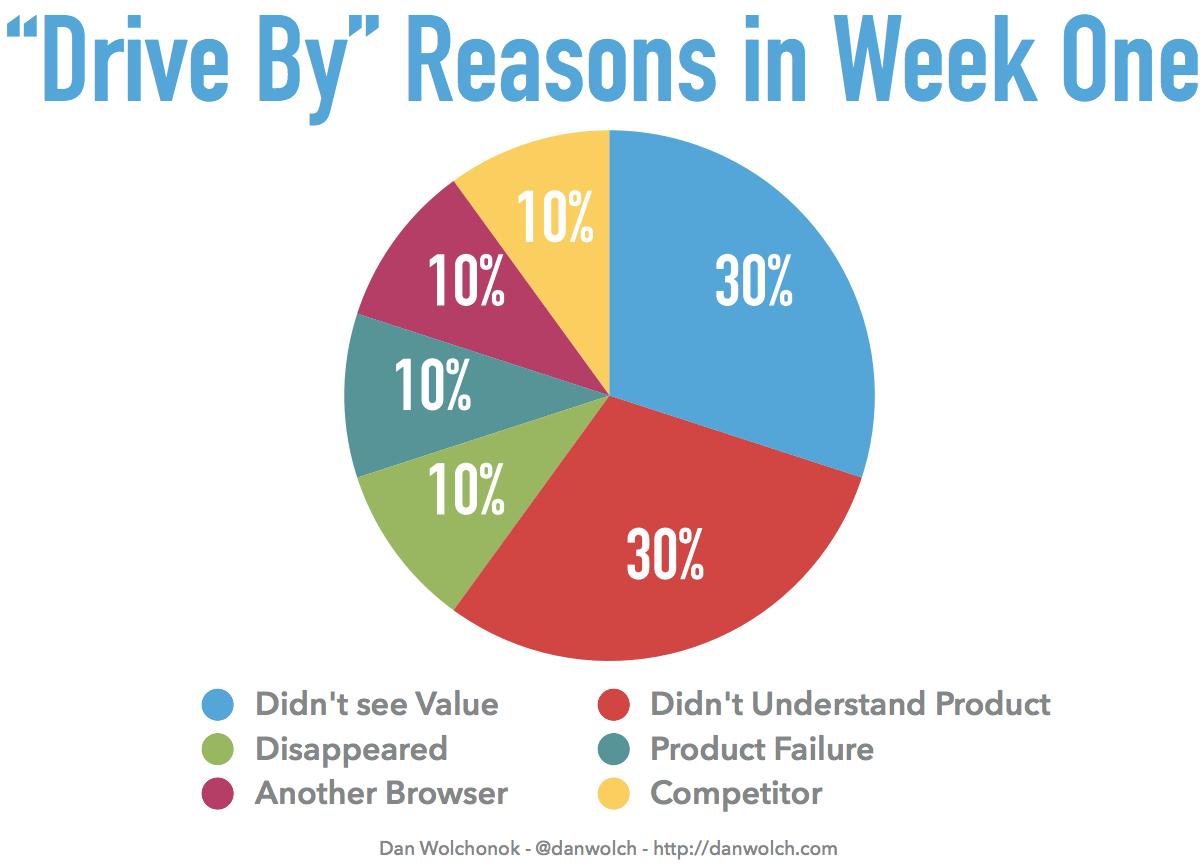

- Dan Wolchonok, Product Manager at Hubspot, simply asked the users of Sidekick (an email tracking tool) why they stopped using the software after a week.

So, what can you do to reduce churn rate and maximize customer lifetime value (CLV) of your business?

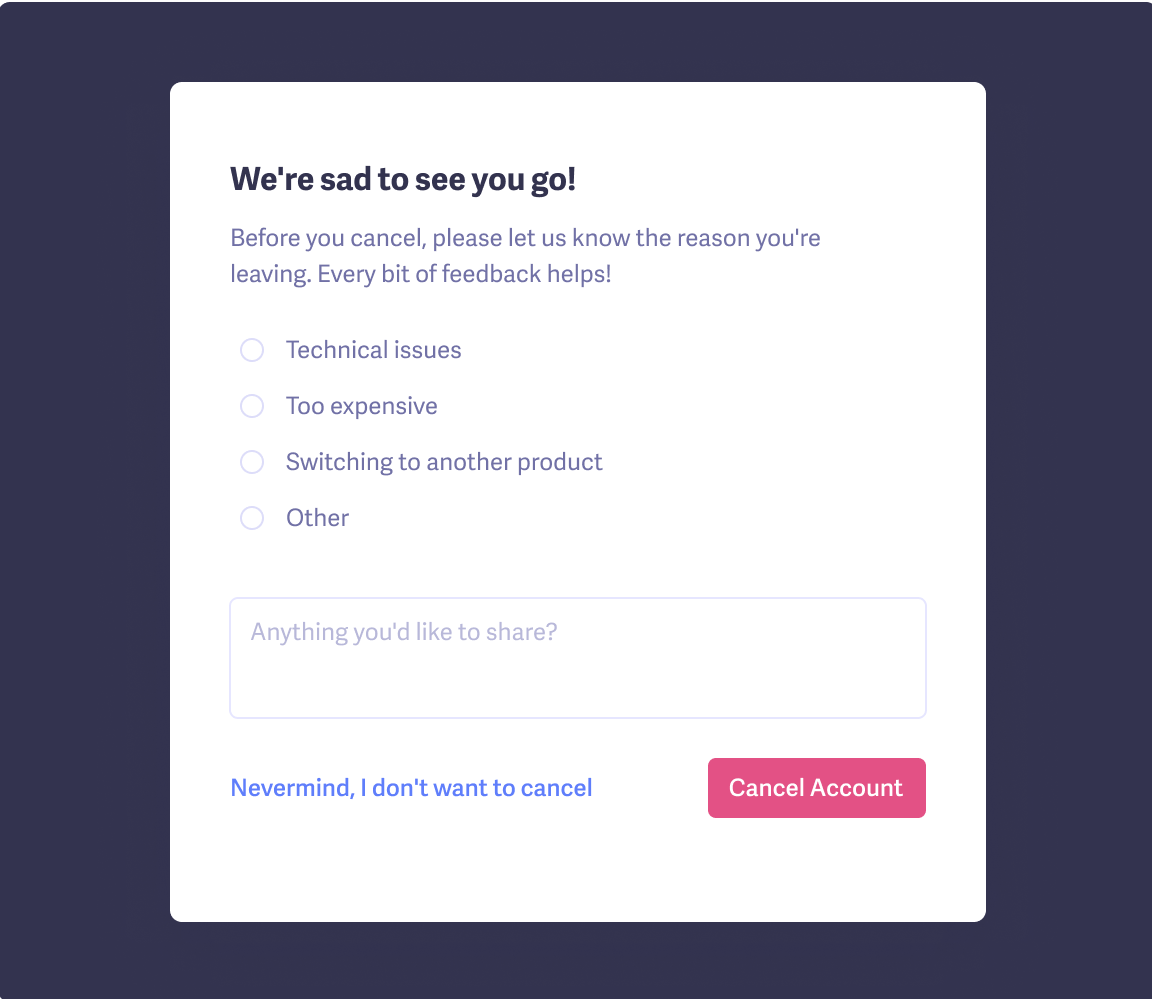

- When a consumer cancels your subscription, simply ask why they are doing it. Use the collected feedback to keep your users.

- One of the proven strategies of reducing churn rate is to make your users pay up-front for your services of product.

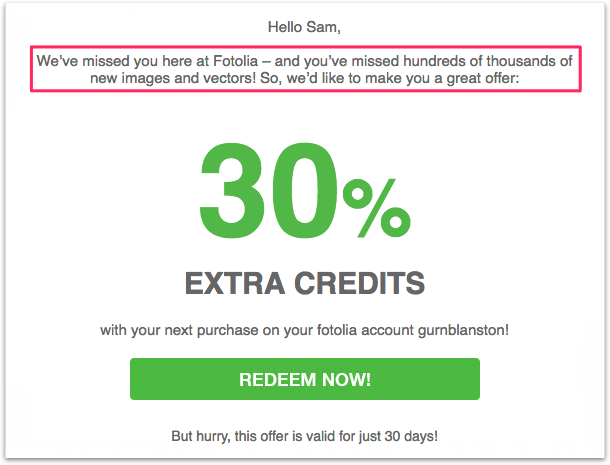

- Find the right channels and keep your customers engaged by constantly communicating with them. Here’s how Fotolia – a Stock Photography company does it.

Takeaway: Consumer churn rate is a big boulder when you are looking to increase customer lifetime value (LTV) of your business.

How to Increase Customer Lifetime Value – Final Words

“Put a dollar in at the top. And the LTV:CAC ratio will tell you roughly how many dollars come out at the bottom. If your money isn’t multiplying, you’re going to want to spend some time tuning that machine” – Brad Coffey, Chief Strategy Officer at HubSpot

Make increasing customer lifetime value a strategic priority. To implement these strategies for CLV boost in your business, you need to bring all the contributing departments on board.

These proven strategies have helped businesses for LTV boost. Which ones have you tried for your business? Let me know in the comments below!

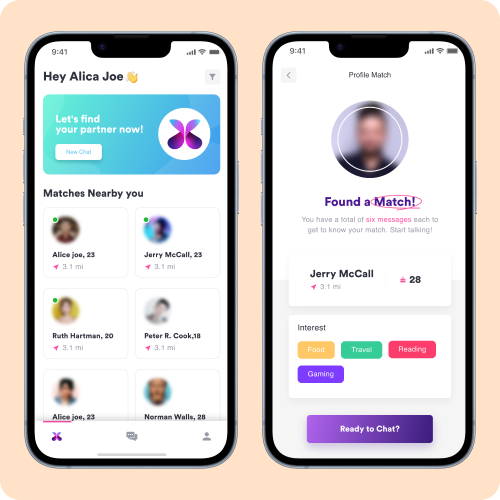

Resourcifi is an award-winning Staff Augmentation company. We provide highly skilled web & app developers, best-in-class digital marketers, and software testers for startups, SMBs, and enterprises. Contact us to know more about our services!

Use our savings calculator to know how much you can save by setting up your team at Resourcifi.